Examining The Unintended Consequences Of Rent Control Policies

UNDERSTANDING THE UNINTENDED CONSEQUENCES OF RENT CONTROL POLICIES FROM THE HOUSING PROVIDERS AND DEVELOPERS POINT OF VIEW.

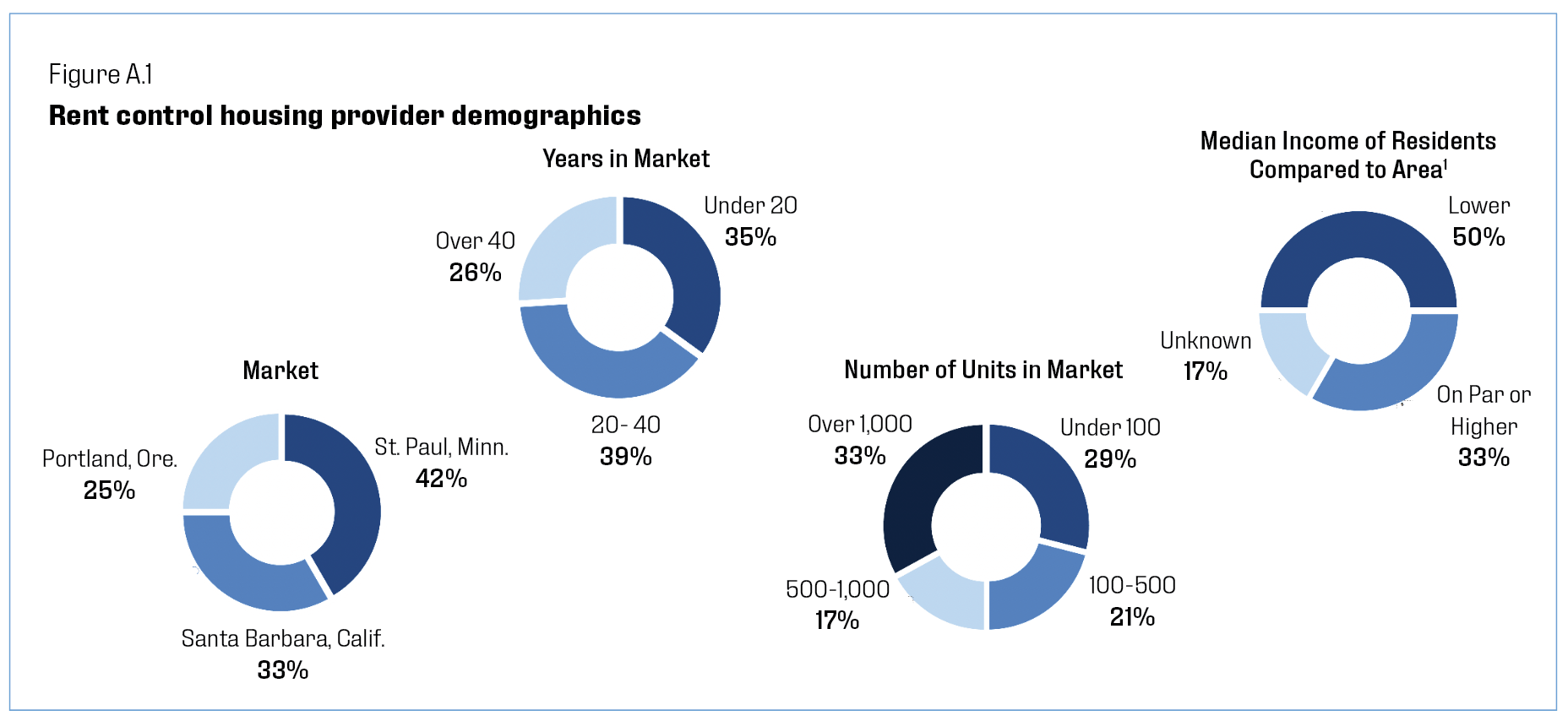

From December 2022 to February 2023, ndp analytics conducted 24 interviews with housing providers and developers from three different markets impacted by rent control policies and proposals: St. Paul, Minn.; Santa Ana/Santa Barbara, Calif.; and Portland/Eugene, Ore. The interviewees ranged from large firms operating thousands of units and having properties across the country to small, mom-and-pop businesses with a handful of units and, often, invested in real estate as part of a retirement plan or second source of income. (See Appendix A for more detail.)

The housing provider research was supplemented with an online public opinion poll of 1,039 respondents across the United States in February 2023. The poll questions focused on housing availability, residential construction and policy perspectives.

Five key findings detailed in this report are:

- Rent control policies reduce investment and development. Over 70% of housing providers say rent control impacts their investment and development plans; actions include reducing investments, shifting plans to other markets and canceling plans altogether.

- Americans are looking for more housing options. Half of the poll respondents said there are not enough options for buyers and renters looking for homes; 35% want more residential development.

- Housing providers absorb the cost of essential maintenance and reduce investments in improvements and nonessential work due to rent control. These financial strains push housing providers to exit the market; 54% said they expect to or would consider selling some assets.

- Rent control policies are often misunderstood as helping only lower-income households, but these policies also subsidize higher-income residents. Nearly half of poll respondents incorrectly believe rent control only provides affordable housing to low- and moderate-income households. However, 58% of housing providers know of higher-income residents who benefit from these policies.

- Americans prefer policies that increase funding for local programs by attracting more business, but rent control deters investment and reduces potential tax revenue. Housing providers contribute significant tax revenue to local governments; however, rent control drives away investment. Most housing providers would not invest in a rent-controlled market again.

FINDING 1. RENT CONTROL POLICIES REDUCE INVESTMENT AND DEVELOPMENT.

While many housing providers want to expand their businesses, they are choosing to reduce or even stop investing in these markets because of rent control and other policies negatively impacting the industry. When asked to rate the negative impact of rent control on development and investment plans using a scale of 1 to 10 (10 being the most significant impact), 71% of housing providers gave a rating of at least 5 and 54% rated the impact above 7, indicating a significant negative impact on development and investment plans. Some business decisions include decreasing investments or shifting to other markets with friendlier policies, while others are pausing or canceling future development altogether (Figure 1).

Rent control deters investment and development in part because it limits the ability to keep pace with operational costs and generate revenue while also signaling a higher risk of future policy restrictions. Housing providers indicated that their business decisions are also impacted by other factors, including the safety and vitality of the community, the political environment, interest rates, operational costs and the mix of current and proposed policies by local, state and federal governments. Additionally, housing providers noted that smaller businesses are hurt most by factors like the policy environment because the complexity and cost of these regulations are difficult to manage (Table 1).

TABLE 1. EXAMPLES OF OTHER FACTORS IMPACTING DEVELOPMENT AND INVESTMENT DECISIONS

COMMUNITY FACTORS

- Anti-business sentiment

- Crime and overall safety

- Economic vitality of downtown areas

- Political environment

ECONOMIC FACTORS

- Housing market trends

- Interest rates

- Operational costs (incl. steep increases in insurance costs)

- Opportunities to earn better or more predictable ROI elsewhere

- Uncertainty about future revenue

PUBLIC POLICY FACTORS

- Complexity of regulations

- Increased regulation or government overreach

- Eviction-related policies

- Taxation

- Vacancy-related policies

- Zoning policies

FINDING 2. AMERICANS ARE LOOKING FOR MORE HOUSING OPTIONS.

Americans are looking for more housing options. The public opinion poll found that half of respondents believe there are not enough options for buyers and renters looking for homes. This sentiment was greatest for respondents with incomes under $50,000, where 53% said there were not enough options, followed by those with incomes between $50,000 and $100,000 (50%) and incomes above $100,000 (46%). While consumers are looking for more housing supply, housing providers and developers are pulling back on investments due to unfriendly housing policies (Figure 2).

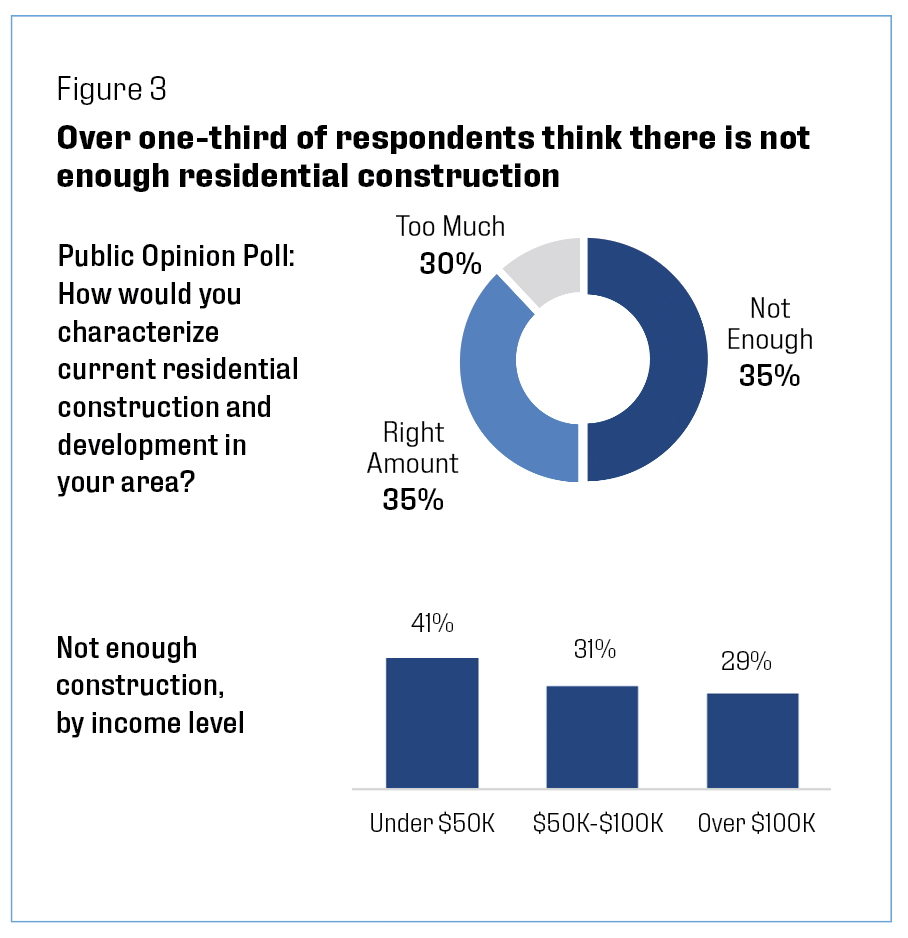

In line with the desire for more housing options, most Americans are either happy with current residential construction levels or are hoping for more. Over one-third of poll respondents want more residential construction, with the highest desire by those with incomes below $50,000 (41%), followed by respondents with incomes between $50,000 and $100,000 (31%) and incomes above $100,000 (29%). However, rent control policies discourage investment and jeopardize future housing projects (Figure 3).

FINDING 3. HOUSING PROVIDERS ARE ABSORBING THE COST OF ESSENTIAL MAINTENANCE BUT NEED TO REDUCE IMPROVEMENTS AND NONESSENTIAL WORK DUE TO RENT CONTROL.

Rising business costs make it even more difficult for housing providers to sustain operations under rent control policies. Just as prices have risen for Americans, housing providers are dealing with increased costs across all areas of their business. Plus, administrative burdens related to compliance further strain resources. Some examples of these increased costs are insurance, labor, utilities, installation and construction services, and accounting and reporting costs related to rent control. Smaller housing providers are often disproportionately impacted because they have fewer resources available to manage sharp price increases, unpredictable expenses and cumbersome regulatory requirements (Table 2).

TABLE 2. EXAMPLES OF RISING COSTS TO HOUSING PROVIDERS

OPERATIONS

- Garbage and recycling

- Insurance

- Maintenance services

- Security services

- Staff wages and benefits

- Utilities

- Taxes

CAPITAL INVESTMENTS

- Appliances

- Building materials

- Installation services

- Construction services

ADMINISTRATIVE BURDENS

- Accounting and reporting requirements related to rent control regulations

- Legal fees, payouts, and lost revenue from eviction-related regulations and backlog

Housing providers have absorbed the increased costs of essential maintenance to ensure the safety and quality of their properties. However, cuts have been or are expected to be made for improvements and nonessential maintenance because of rent control policies. Of the housing providers interviewed, 61% have had or expect to defer nonessential maintenance or improvements (Figure 4).

The long-term financial strain of rising costs and limited revenue is not sustainable. Some housing providers are looking to or would expect to decrease their current footprint due to rent control policies. Over half of the housing providers interviewed indicated that they have considered or would consider selling off properties due to rent control policies (54%). Very few would consider converting to condominiums (8%); these decisions are often a product of the type of housing, market conditions and regulations related to condominiums and conversions.

FINDING 4. RENT CONTROL POLICIES ARE OFTEN MISUNDERSTOOD AS HELPING ONLY LOW- AND MODERATE-INCOME HOUSEHOLDS, BUT HIGHER-INCOME RESIDENTS BENEFIT.

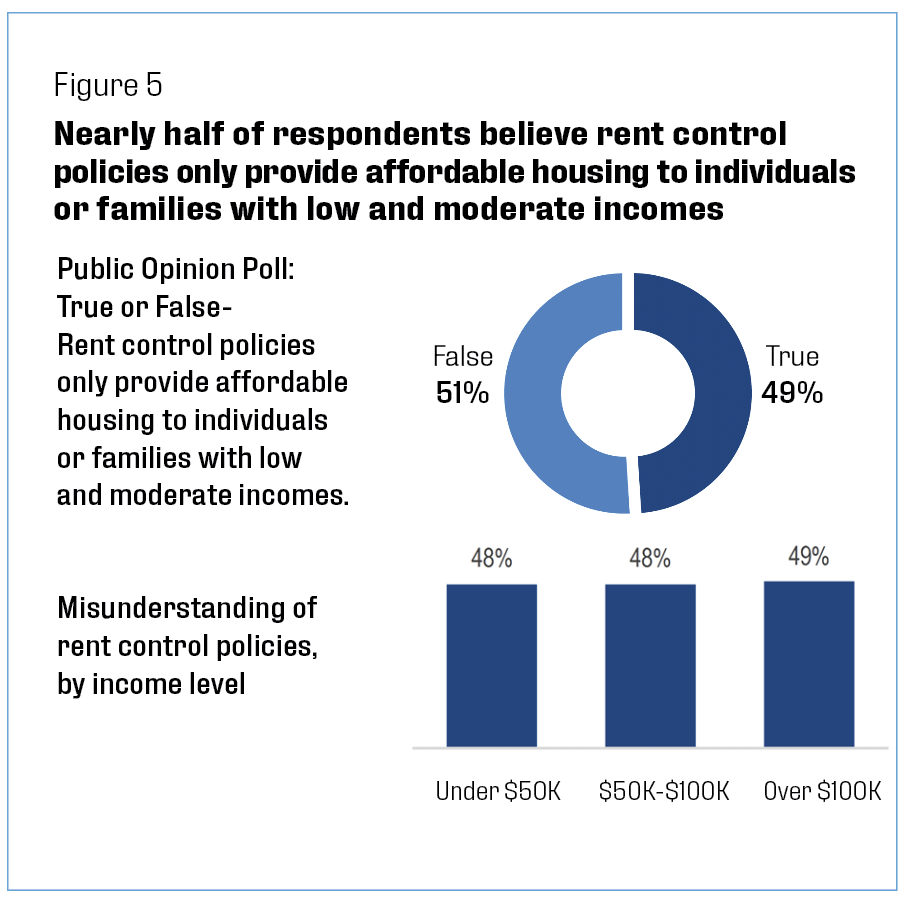

Rent control subsidizes housing for all residents. However, there’s a common misconception that these policies serve low- and moderate-income households only. Nearly half of poll respondents believe that rent control policies only provide affordable housing to individuals or families with low and moderate incomes. The share of respondents that misunderstood rent control policies was similar across income levels (Figure 5).

However, higher-income residents do benefit from rent control. During the interviews, 58% of housing providers said they were aware of higher-income residents occupying rent-controlled apartments. Furthermore, housing providers have observed how rent control restricts mobility and reduces options for housing, especially for low- and moderate-income households. Due to under-market rates, residents have less incentive to move as their lifestyles change. In an unregulated market, households often look to upgrade housing when they realize increased income or expand their families. In a regulated market, those households often choose to stay put longer, reducing mobility and housing options. Another unintended consequence is that rents are often higher up front and less flexible because of the limitations of rent control policies and the uncertainty about future policy changes. Finally, there is some concern over residents subletting units at market rates for profit, which has happened in highly controlled markets like San Francisco (Figure 6).

FINDING 5. AMERICANS PREFER TO INCREASE FUNDING FOR LOCAL PROGRAMS BY ATTRACTING MORE BUSINESS, BUT RENT CONTROL DETERS INVESTMENT AND REDUCES POTENTIAL TAX REVENUE.

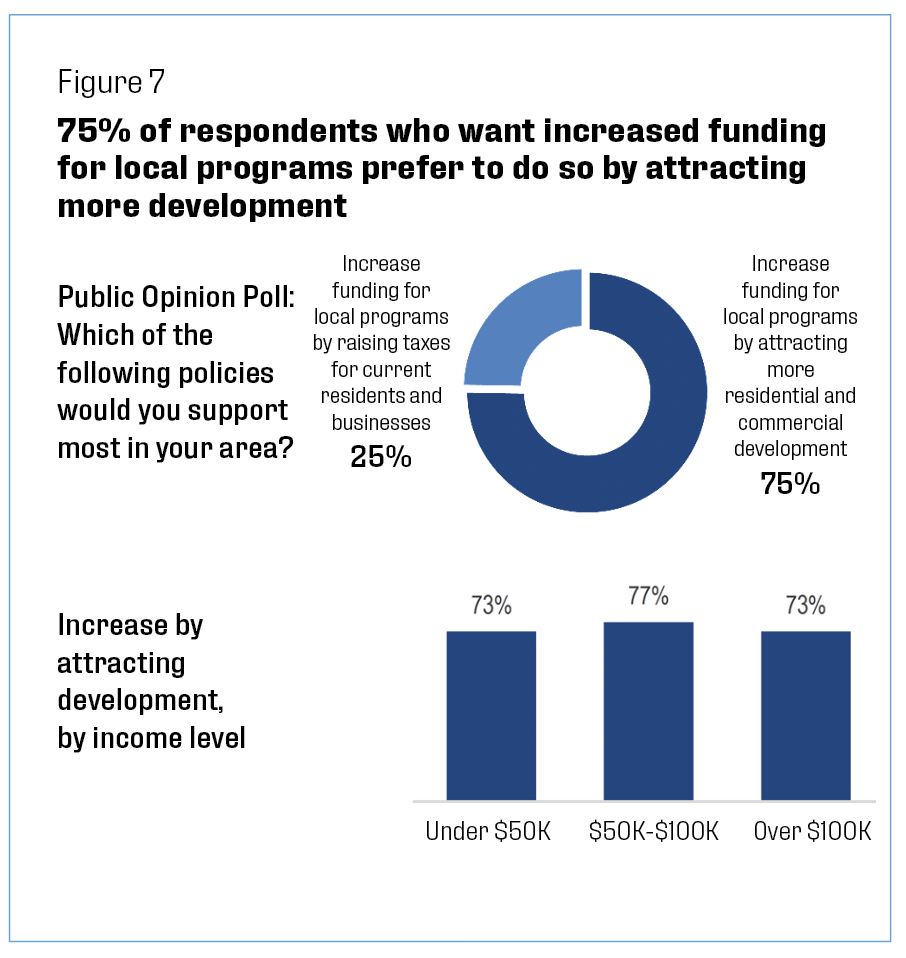

Unfriendly policies drive out housing providers, compromising an essential source of tax revenue for local governments. However, the significant tax contributions of housing providers are often overlooked. This income funds infrastructure, schools, parks, transportation and other needs. Of the poll respondents that favored increased spending for local programs, 75% preferred generating additional funding by attracting more development instead of raising taxes. This preference was highest for respondents with income between $50,000 and $100,000; 77% said they would prefer to attract development over raising taxes (Figure 7).

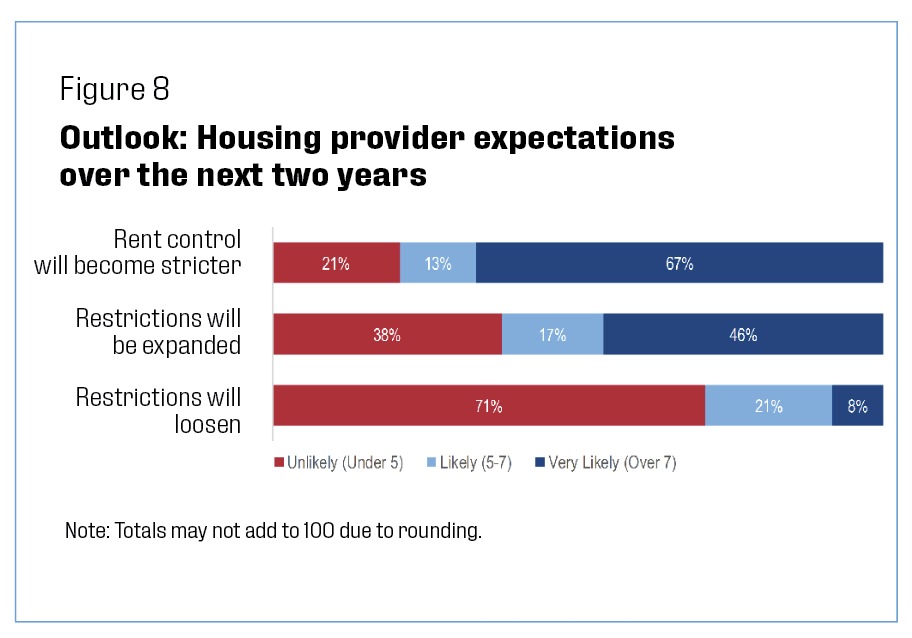

While Americans support encouraging development, policies like rent control deter it. Housing providers are not optimistic about the outlook in their current markets. During the interviews, housing providers were asked to rate the likelihood of different policy outcomes over the next two years on a scale of 1 to 10 (10 being extremely likely). Nearly 80% expect rent control policies to become stricter (rating 5 and up); two-thirds say this outcome is very likely (rating over 7). Over half of respondents expect more restrictions on housing providers over the next two years; 46% say this outcome is very likely. Under 30% expect some restrictions to loosen (Figure 8).

These expectations impact business decisions. Housing providers have adjusted plans for investment and development based on their expectations of future housing policies and have also weighed decisions to sell off assets. At least in the short term, housing providers continue to operate in their current markets. However, they do not expect to invest or develop in other markets with rent control. About two-thirds of housing providers said they would absolutely not consider investing in markets with strict rent control policies; one-third would consider it if the location and market conditions were right, although very few could name an area where they’d be willing to invest.

Rent control and other policies negatively impacting housing providers restrict future housing supply and limit potential tax revenue critical to funding local programs. Policies that attract more development help current residents, businesses and governments.

APPENDIX A. HOUSING PROVIDER INTERVIEWS

From December 2022 to February 2023, ndp analytics interviewed 24 housing providers on the impacts of rent control policies in three markets: Portland/Eugene, Ore.; Santa Ana/Santa Barbara, Calif.; and St. Paul, Minn. The National Apartment Association (NAA) identified the target markets, and the company representatives volunteered to participate via NAA and local apartment associations. The rent control interviews were conducted via Zoom by staff at ndp analytics. Responses were collected and aggregated using industry best practices. The company demographics of respondents are below (Figure A.1).